.webp)

Navigating the Shifting Landscape of Home Health Care Finance

Navigating the Shifting Landscape of Home Health Care Finance

In today's rapidly evolving healthcare sector, home care agencies face unprecedented challenges in managing their revenue cycles. Recent changes in regulations, technology, and public health policies have created a complex financial environment that demands new strategies and solutions. This article by RapidClaims explores these challenges in depth and offers insights on how home health care providers can adapt and thrive in this changing climate.

The Medicaid Disenrollment Crisis: A Case Study in Adaptability

The end of the COVID-19 public health emergency triggered a massive Medicaid eligibility review across states, resulting in widespread disenrollments. This situation created a perfect storm for home care agencies:

- Sudden loss of eligible clients: Agencies saw 10-30 clients disenrolled each month at no fault of their own.

- Administrative backlogs: County-level staffing shortages led to delays in processing redeterminations.

- System failures: New case management systems introduced simultaneously often malfunctioned, exacerbating the problem.

- Continued service provision: Many agencies chose to continue services without guarantee of payment, risking financial stability.

Innovative agencies responded with multi-faceted approaches:

- Forming dedicated teams to assist clients with re-enrollment.

- Filing over 100 of appeals and escalation forms on behalf of clients.

- Maintaining services to retain caregivers and clients, despite financial risk.

- Leveraging technology to track multiple claim submissions (some claims required 10-15 resubmissions).

This crisis highlighted the critical need for robust revenue cycle management (RCM) systems and processes, leading to the evolving role of tech in Modern RCM.

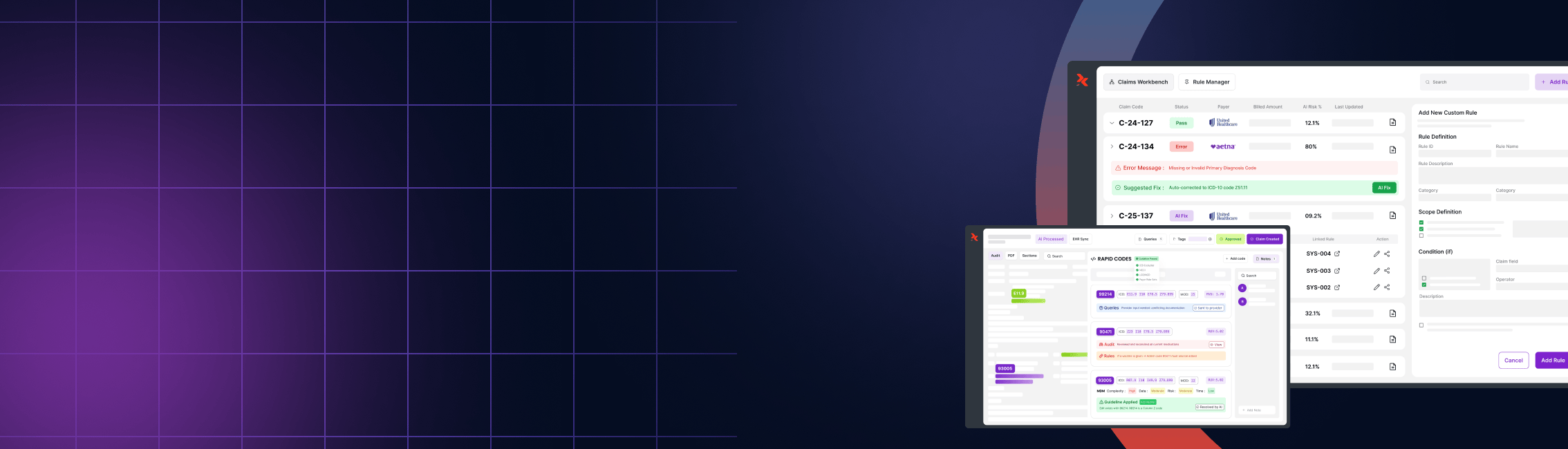

The Evolving Role of Technology in Modern RCM

To navigate these challenges, agencies must leverage advanced technology solutions. Key features of effective RCM systems include:

- Efficient claim submission and tracking: Ability to generate and submit claims quickly and accurately.

- Easy resubmission of denied claims: Streamlined processes for correcting and resubmitting rejected claims.

- Integration of electronic remittance advice: Automatic reconciliation of payments received against submitted claims.

- Forecasting tools for cash flow management: Predictive analytics to anticipate revenue and expenses.

- Comprehensive reporting: Detailed insights into financial performance and trends.

Electronic Visit Verification (EVV) and Its Impact on Billing

The introduction of EVV has added another layer of complexity to the billing process for home health care providers. Agencies must ensure that all six required data points are captured accurately:

- Type of service performed

- Individual receiving the service

- Date of service

- Location of service delivery

- Individual providing the service

- Time the service begins and ends

Failure to capture any of these points can result in immediate claim rejection, underscoring the need for systems that seamlessly integrate EVV data with billing processes, ensuring a reduction in denials.

Key Performance Indicators for Financial Health in Home Health

Successful agencies closely monitor several KPIs:

- Client numbers and service hours: Tracking both total clients and hours per client to identify trends.

- Revenue and costs: Detailed breakdown by service type and payer source.

- Intake rates: Monitoring new client acquisition and onboarding efficiency.

- Payment collection percentages: Tracking the percentage of billed amounts actually collected.

- Profitability by client or service type: Identifying which services or client types are most profitable.

- Caregiver retention rates: As this directly impacts service quality and consistency.

- Claim denial rates and reasons: To identify areas for improvement in documentation and billing processes.

Comprehensive Advice for Agency Owners and Administrators

To improve RCM practices in this new landscape:

- Invest in a comprehensive RCM system that can handle the increasing complexity of claims processing and adapt to regulatory changes (crucial).

- Develop processes to quickly identify and respond to claim rejections or payment delays, including a dedicated team for complex cases and appeals.

- Train staff extensively on the importance of accurate data entry, documentation, and EVV compliance.

- Stay informed about regulatory changes through active participation in industry associations and regular review of state and federal guidelines.

- Consider creating a dedicated team for managing complex cases, appeals, and client assistance with eligibility issues.

- Implement a robust forecasting system to anticipate cash flow challenges and plan accordingly.

- Regularly audit your billing processes to identify inefficiencies and areas for improvement.

The Future of Home Health Finance: Preparing for What's Next

As the healthcare landscape continues to evolve, agencies must remain agile and proactive. This may involve:

- Diversifying payer sources to reduce reliance on any single program, including exploring private pay options and partnerships with Medicare Advantage plans.

- Exploring value-based payment models and preparing systems to track and report on quality metrics. (For any providers considering a switch to VBC, do reach out.)

- Investing in staff training and retention to maintain high-quality care, recognizing the direct link between caregiver satisfaction and financial performance.

- Collaborating with other agencies or healthcare providers to share best practices and potentially leverage economies of scale.

- Embracing telehealth and remote patient monitoring technologies to expand service offerings and improve efficiency.

Conclusion: Embracing Technology for Financial Stability

The financial management of home health agencies has become increasingly complex, but with the right strategies and tools, it's possible to thrive in this new environment. By focusing on efficient RCM practices, leveraging advanced technology, and staying adaptable, agencies can continue to provide vital services while maintaining financial stability.

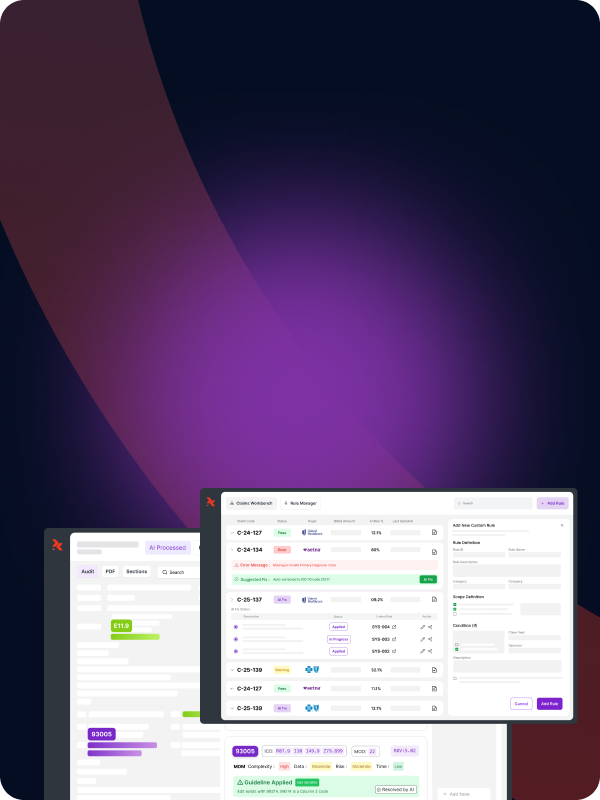

As providers look to upgrade their RCM capabilities, solutions offered by companies like RapidClaims offer promising avenues for improvement and much needed customization around coding.

In an era where accurate coding and documentation are more crucial than ever, integrating AI-powered solutions like those offered by RapidClaims can significantly enhance an agency's ability to navigate the complex world of home health RCM. By leveraging such advanced technologies, agencies can not only improve their financial performance but also free up resources to focus on what matters most: providing high-quality care to those in need.

%201.png)